louisiana state irs phone number

The IRS made the OIC program more attractive because it revised the calculation of the taxpayers future income allowed taxpayers to repay student loans allowed taxpayers to pay state and local delinquent taxes and expanded. What does my company need to do to become a registered vendor for the State of Louisiana.

Irs Installment Agreement Franklin Park Il 60131 Mm Financial Consulting Inc Irs Taxes Payroll Taxes Income Tax

A trust is a legal entity created under state law and taxed under federal law in which one party holds assets for the benefit of another.

. Income Tax Return for Estates and Trusts to report its income deductions gains and losses. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a LA state returnThe Louisiana tax filing and tax payment deadline is May 15 2022Find IRS or Federal Tax Return deadline details. Partner with Us to.

A corporation is a person or group of people who establish a legal entity by filing Article of Incorporation with the states secretary of state granting it certain legal powers rights privileges and liabilities. Apply-irs-einus offers a paid service in which its employees or agents will prepare and submit your Employer Identification Number Application EIN Application to the IRS on your behalf. An Estate is a legal entity created as a result of a persons death.

By mail if youre getting letters from the IRS then theres a good chance you have tax debt. It will provide immediate scale to TD in Louisiana and Tennessee while filling in holes in. 2022 Tax Season Statistics As of Feb 4th a total of 16685000 returns have been received with 12992000 processed and 4330000 refunds issuedThe IRS expects to get over.

Govt Assists business-to-business service will process your application for an EINTax ID number SS-4 Form with the IRS to obtain a business Tax ID Number and deliver it to your email quickly and securely. By using this site you agree to the use of cookies. To file an applicant generally must include the name and address of the corporation its.

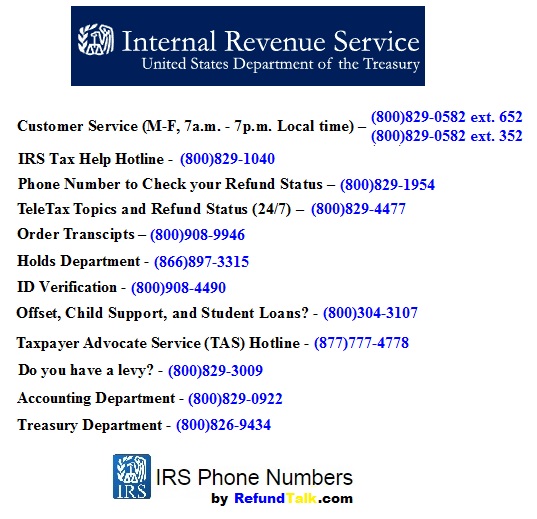

The main IRS phone number is 800-829-1040 but this list of other IRS numbers could help you skip the line spend less time on hold or contact a human faster. Income Tax Return for Estates and Trusts to report its income deductions gains and losses. The IRS most commonly recognizes December as the end of the accounting year but this is not always the case.

STEP provides an exemption from all tuition charges at a Louisiana state supported educational institution. On-Line Taxes can assist you with the status of your tax return however we do not know the status of your refund from the IRS or your State. We are an Authorized IRS e-file Provider and act as a third-party designee to obtain your EIN.

Check the Status of Your Income Tax Refunds. Articles of incorporation must be filed with a state for a business to incorporate. And mail takes 4 weeks.

For more information see Tax Topic 104. Obtain IRS EIN Number employer identification number. Establish the business physical andor mailing address phone number voicemail website email address and business cards.

Louisiana State Tuition Exemption Program STEP. If you owe back taxes ignoring letters doesnt make the IRS or your tax debt go away. If you have done business with the State and need to verify that your information is correct or need additional assistance with your vendor record contact the OSRAP Vendor Section at 2253421097 or DOA-OSRAP-LAGOVlagov.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. In-person - go to the nearest IRS office. County Consumer Protection Offices Jefferson Parish District Attorneys Office Website.

The officials listed in this section regulate and supervise state-chartered banks. Once you submit your return with OnLine Taxes you will need to check your status in 24-48 hours to ensure acceptance. Louisiana Secretary of State Corporations Division Telephone.

We know the tax laws we know your rights and we get you results. Our agents will only call you if there is an issue with your application. The provided information does not.

Jefferson Parish District Attorneys Office. By phone - call the IRS at 800-829-1040 Monday through Friday 7 am. You must submit a Federal W9 Form Request for Taxpayer Identification Number and Certification before any awards purchase orders can be issued to your company.

If you are in the New Orleans area call the Taxpayer Advocate Service at 504-558-3001. LLC University will show you how to get an EIN Number Federal Tax ID Number for a Louisiana LLC. The Estate pays any debts owed by the decedent and distributes the balance of the Estates assets to the beneficiaries of the Estate.

Theres a real problem with out-of-state companies claiming they can help you with your tax issues. You can get an EIN for your Louisiana LLC online by fax or by mail. Call the IRS Phone Number and Tell Them.

If you are outside of the New Orleans area call 877-777-4778. Applying for an EIN with the IRS is free 0. 900 North 3rd Street Baton Rouge LA 70802.

Fax takes 4 business days. Contact information for the Louisiana governor and key state agencies. The Estate consists of the real estate andor personal property of the deceased person.

Online approval takes 15 minutes. A trust is required to file a Form 1041 US. This is based on IRS filing statistics and can change over time as late filings or refunds are processed.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Select the State of the Executor Administrator or Personal Representative. Louisiana State Income Taxes for Tax Year 2021 January 1 - Dec.

You can register and maintain your profile in LaGov here. John Bel Edwards. Please enter the best phone number for the applicant.

At Bryson Law Firm LLC our focus is on taxes. This exemption may be used for five separate academic years or until the Service member receives an associates bachelors or masters degree or professional certificate or degree. A trust is required to file a Form 1041 US.

Thats why you need a tax lawyer to fight for you in front of the IRS and the state of Louisiana. What to Do If You Cant Resolve Your Issue. What is an Estate of a Deceased Individual.

The table below shows the average IRS federal refund payment over the last few years. Alternatively for no charge you can visit the official IRSgov website and complete your EIN Application on your own. Find contact information and major state agencies and offices for the government ofLouisiana.

Select your state on the map below to find the phone number and address of. If you cant resolve your situation with us. A trust is a legal entity created under state law and taxed under federal law in which one party holds assets for the benefit of another.

See Publication 1546 The Taxpayer Advocate Service of the IRS PDF. Each state has at least one Local Taxpayer Advocate who is independent of the local IRS office and reports directly to the National Taxpayer Advocate.

In An Effort To Make Things Easier For Taxpayers And Tax Forms Issuers The Internal Revenue Service Irs Is Bringing B Irs Tax Forms Internal Revenue Service

Hottest Pic Form 15 Health Care Coverage Form 15 Health Care Coverage Will Be A Thing Of The Past And He Tax Forms Health Care Coverage Federal Income Tax

Irs Installment Agreement Aurora Co 80011 Mmfinancial Org 866 487 5624 Tax Help Irs Taxes Debt Help

Received A Notice From The Irs Or Department Of Revenue Here S What You Need To Do Sacco Tax

Managed Service Provider Proposal Template Business Proposal Template Proposal Templates Request For Proposal

Irs Phone Numbers Where S My Refund Tax News Information

North Louisiana Family Is A Major Force In The State S Vast Prison Industry Incarceration Picture Writing Prompts Classroom Charts

Employment Verification Letter Letter Of Employment Samples Template Letter Of Employment Lettering Letter Of Employment Template

Pin On Los Angeles Tax Attorney

Louisiana Tax Deadline Extension And Relief For Winter Storm Victims Tax Deadline Winter Storm Storm

We Solve Tax Problems Tax Debt Debt Relief Programs Tax Debt Relief

State Of Ohio Refund Cycle Chart 2014 29 Louisiana State Tax Forms Picture Louisiana State Tax Forms Chart State Tax

Irs Building Washington Dc Washington Dc World Building

Irs Phone Numbers Where S My Refund Tax News Information

Order Blank W 9 Forms In 2021 Tax Forms Irs Forms Doctors Note Template

When The United States Declared Bankruptcy Pledged All Americans As Collateral Against The National D Birth Certificate Birth Certificate Template Certificate

Apple Products Fan On Twitter Filing Taxes Tax Deductions Tax Forms

Refund Cycle Chart For Tax Year 2014 Illinois State Refund Cycle Chart Elegant Louisiana Stat Personal Financial Statement Label Templates Financial Statement